The S&P 500 (SP500) on Friday ended 1.53% higher for the holiday-shortened week amid muted trading, with the benchmark index gaining in two out of five sessions.

U.S. markets were closed on Thursday on account of Thanksgiving and shut earlier at 1 p.m. ET. on Black Friday.

While the week began on a sour note amid concerns that China could further tighten zero-COVID restrictions, markets were broadly subdued. The week also saw the release of the minutes of the last FOMC meeting, which showed that policymakers could slow the pace of rate hikes soon.

In other economic news, durable goods orders jumped more than expected, U.S. PMI Composite Flash slid deeper into contraction, weekly initial jobless claims rose to a three-month high, new home sales unexpectedly rose and mortgage applications rose 2.2%.

Meanwhile, Michigan Consumer Sentiment figures were higher than expected and the Chicago Fed National Activity Index turned negative again. Additionally, the National Retail Federation projected a 6-8% increase in holiday shopping.

The SPDR S&P 500 Trust ETF (NYSEARCA:SPY) on Friday climbed 1.59% for the week alongside the benchmark index. The ETF is -15.8% YTD.

All 11 S&P 500 (SP500) sectors ended the week in the green, with Utilities and Material topping the list. See below a breakdown of the weekly performance of the sectors as well as the performance of their accompanying SPDR Select Sector ETFs from Nov. 18 close to Nov. 25 close:

#1: Utilities +3.04%, and the Utilities Select Sector SPDR ETF (XLU) +3.04%.

#2: Materials +2.92%, and the Materials Select Sector SPDR ETF (XLB) +2.98%.

#3: Financials +2.16%, and the Financial Select Sector SPDR ETF (XLF) +2.09%.

#4: Consumer Staples +2.1%, and the Consumer Staples Select Sector SPDR ETF (XLP) +2.1%.

#5: Real Estate +1.99%, and the Real Estate Select Sector SPDR ETF (XLRE) +1.97%.

#6: Health Care +1.91%, and the Health Care Select Sector SPDR ETF (XLV) +1.92%.

#7: Industrials +1.9%, and the Industrial Select Sector SPDR ETF (XLI) +1.87%.

#8: Consumer Discretionary +1.13%, and the Consumer Discretionary Select Sector SPDR ETF (XLY) +1.16%.

#9: Communication Services +1.01%, and the Communication Services Select Sector SPDR Fund (XLC) +1.35%.

#10: Information Technology +0.98%, and the Technology Select Sector SPDR ETF (XLK) +1.14%.

#11: Energy +0.26%, and the Energy Select Sector SPDR ETF (XLE) +0.26.

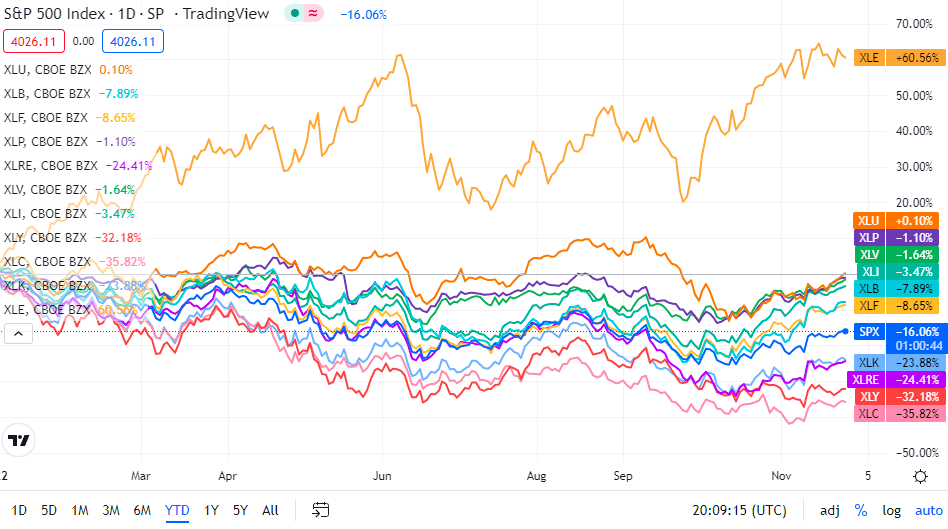

Below is a chart of the 11 sectors’ YTD performance and how they fared against the S&P 500. For investors looking into the future of what’s happening, take a look at the Seeking Alpha Catalyst Watch to see next week’s breakdown of actionable events that stand out.